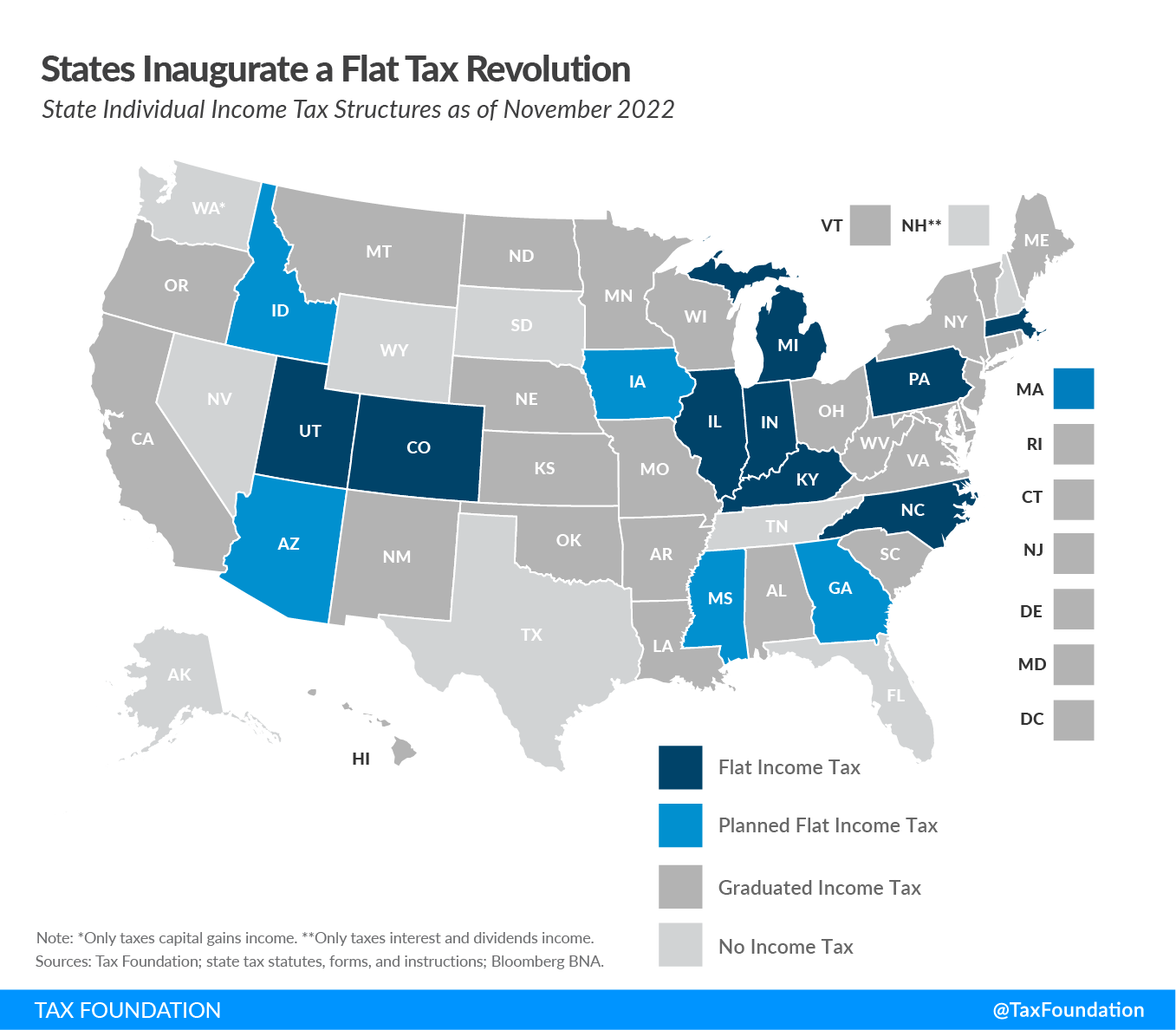

Four more states move to a flat tax. Illinoisans were right to reject Pritzker's progressive income tax. – Wirepoints | Wirepoints

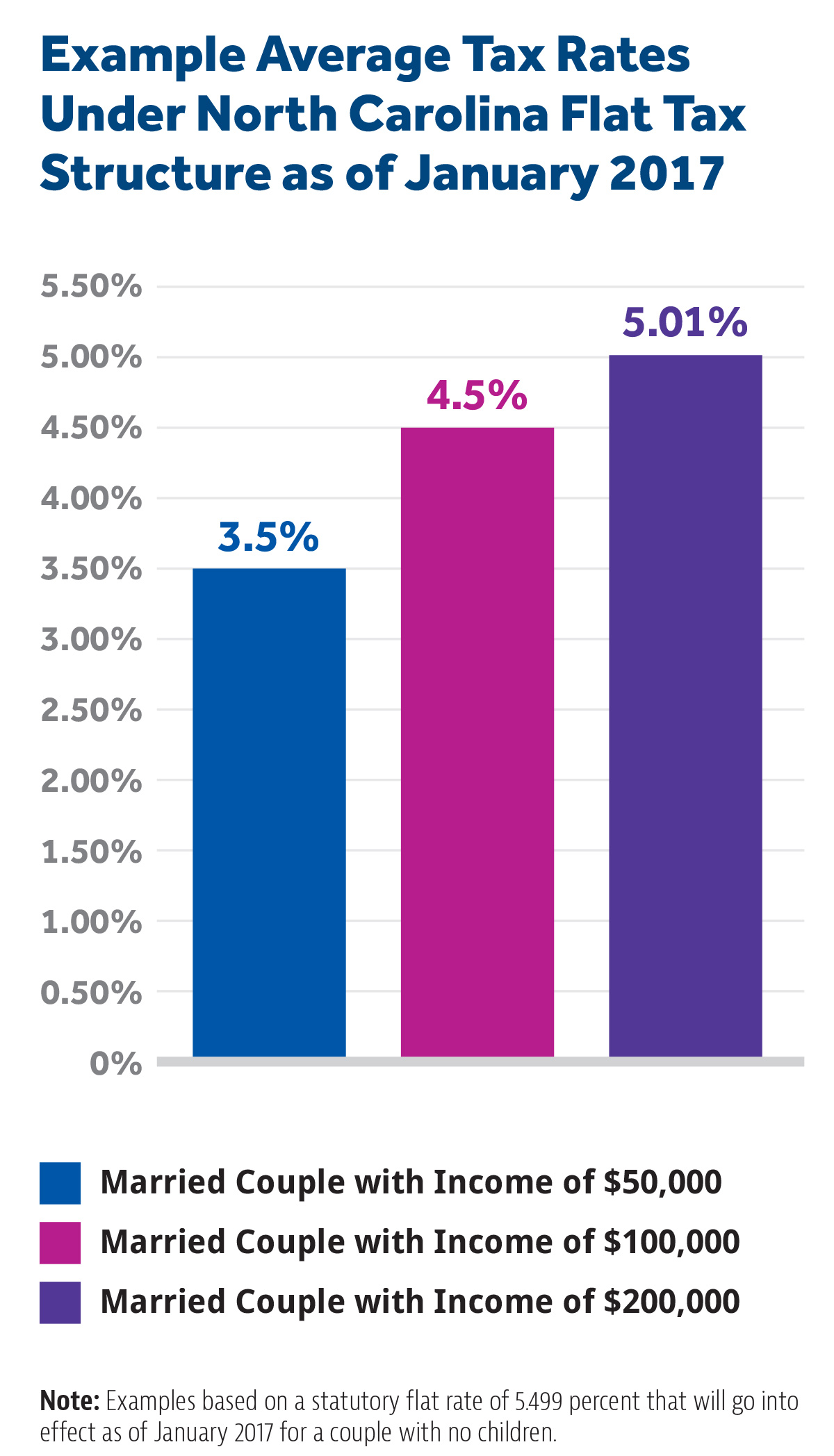

Illinois used to have one competitive advantage over its neighbors: its flat tax. Now that's largely gone | Madison - St. Clair Record

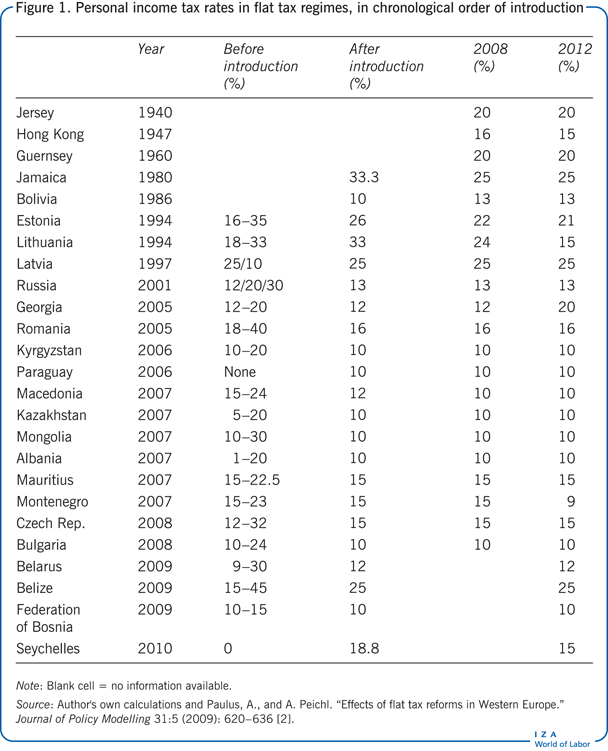

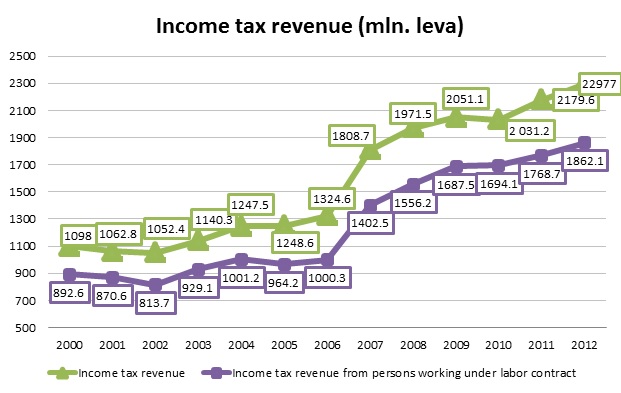

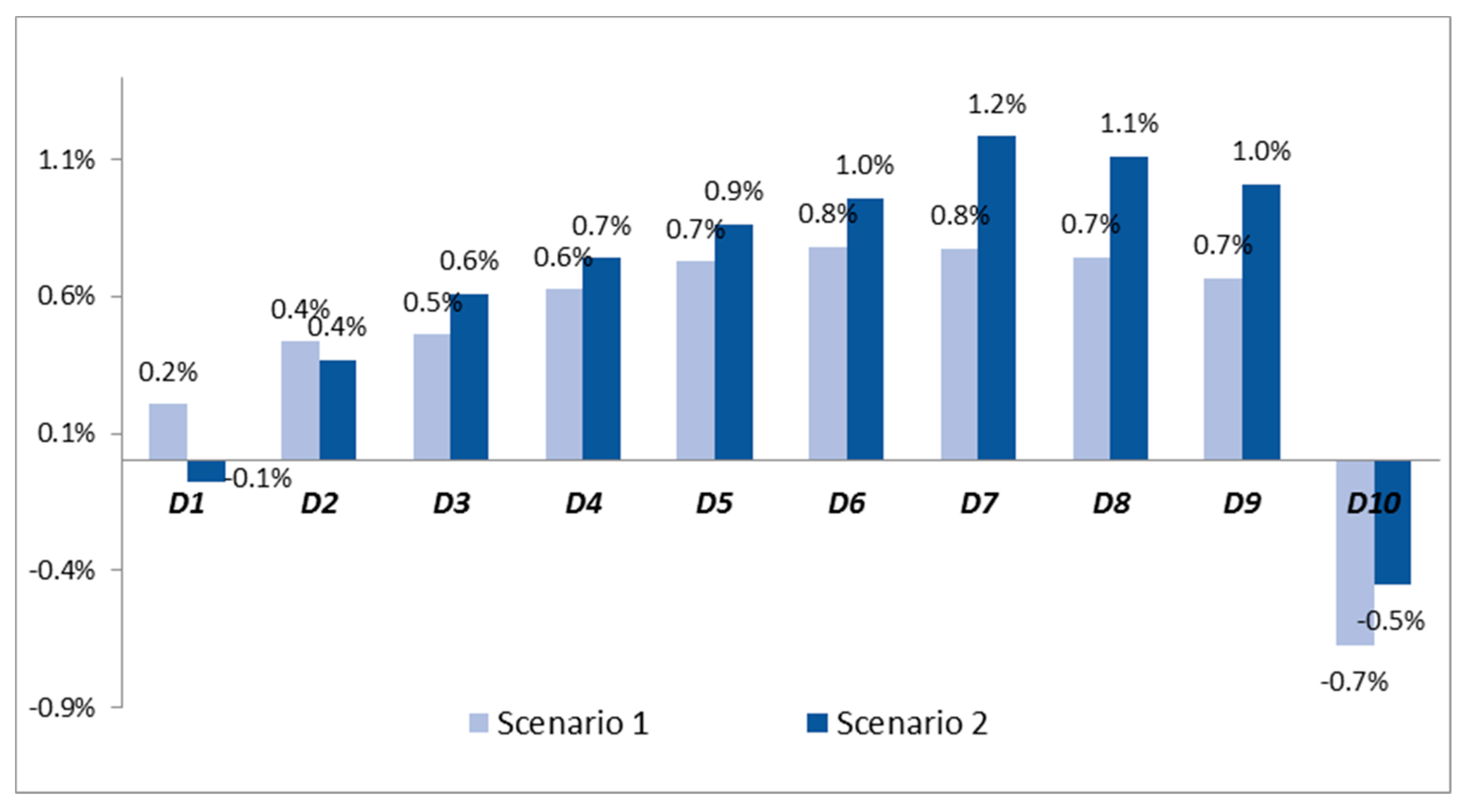

Sustainability | Free Full-Text | Flat-Rate versus Progressive Taxation? An Impact Evaluation Study for the Case of Romania

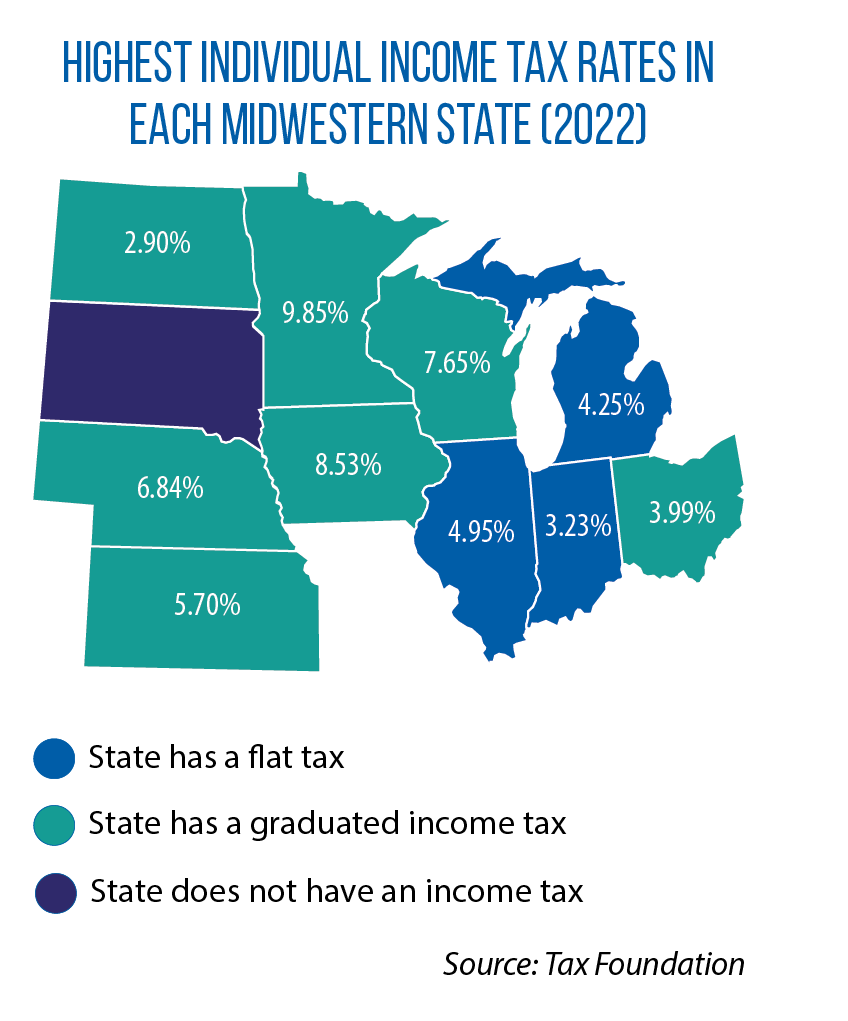

Iowa switching to flat income tax system, joining three other states in Midwest - CSG Midwest - CSG Midwest